2023 Q3 Market Commentary…

As an experiment, I took a crack at letting ChatGPT write this quarter’s market commentary. It was quite impressive how quickly it built the page. It took less than 30 seconds! Then, I read through it, and I was reminded that speed is not a substitute for accuracy. In the section regarding U.S. markets, it stated that market indices were at all-time highs, which is woefully incorrect. None of the U.S. stock market indices have regained their high points set back in late 2021. Next, it wrote a paragraph citing climate change and how renewable energy stocks are benefitting from accelerated acceptance and supportive policies. In fact, the most widely held clean energy ETF, iShares Global Clean Energy ETF, is down mid-single digits year-to-date in percentage terms so far in 2023. Suffice to say, artificial intelligence has some room for improvement.

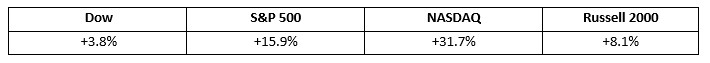

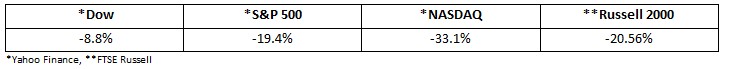

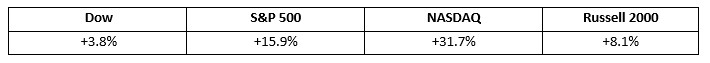

Due largely to AI and cloud computing enthusiasm, the NASDAQ recorded its best start to the first half of the year since 1983. Yet, we quickly forget how far down these stocks fell in 2022. For example, META (aka Facebook) stock is currently trading around $289/share as of this market commentary, which is a whopping 141% year-to-date return. On September 1, 2021, META hit its all-time high price of $384.33. So, even with its meteoric rise this year, META is still off 25% from its all-time high price. This is not typical price action for any stock, let alone a large cap stock. When you consider that the historical average annual rate of return for the S&P 500 Index from years 1993 through the end of 2022 was 7.52%, the trajectory on such large stocks seems both unpredictable and unsustainable. META is just one example. There are a handful of other large cap stocks that have been similarly irrationally exuberant. You can guess, by reviewing the following table, which area of the market benefited most. Here are the 1st half results of the major indices…

So, how do we approach an irrational stock market with so few stocks generating such abnormal returns? We own a measured amount of some of those names either individually or in ETF’s, and we are very tactical with the rest of the portfolio. One asset class that has been beneficial in reducing overall portfolio risk has been treasury bonds. We’ve been able to purchase treasuries that are producing yields not seen in over a decade. Owning treasuries at higher yields tamps down the inordinate risk of current markets. If the Fed continues to aggressively fight inflation, we should continue to see attractive short-term yields on treasuries, and we’ll continue to reinvest into them as they reach their maturity dates.

We anticipated a more challenging 2nd quarter for equities, but the stock market stayed resilient. It is still a very narrow market, which means just a handful of large stocks continue to do the heavy lifting for market returns. Is it possible for a dozen stocks to hold the market up for an extended period? It’s possible, but not probable based on predicted corporate earnings for the second half of the year.