2023 Q2 Market Commentary…

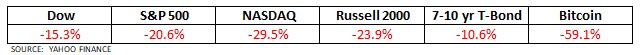

Approximately 50% of the NASDAQ 100 Index is concentrated in just seven stocks – Meta, Apple, Google, Microsoft, Amazon, NVidia, and Tesla. These seven stocks had a solid quarter in performance terms, yet only Apple stock is trading anywhere near all-time highs set back in the fall of 2021. Perhaps, these seven stocks were viewed by investors as a “safe haven” amidst a broader stock market that does not look much healthier than it did in all of 2022.

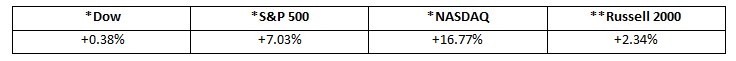

Tens of thousands of employees were let go by these seven companies and others in the first quarter of 2023. Job cuts can provide a boost to the company stock price, but it’s a strategy that only helps the bottom line, not the top line. It’s the top line (gross sales and revenue) that matters most, and the next wave of quarterly earnings this spring could paint a dismal picture across many companies and sectors. Nevertheless, for at least the first quarter, tech stocks gave the market some relief. (See Q1 2023 performance chart below)