Q4 2021 Market Commentary…

What is the U.S. debt ceiling? It’s simply a dollar cap limit that the US Government places on its own authority to raise money by issuing government bonds to continue to meet its obligations like social security payments, tax refunds, interest payments on existing debt, government employee salaries, military salaries, just to name a few. Since 1917, Congress has raised the debt limit 78 times (See Citation 1).

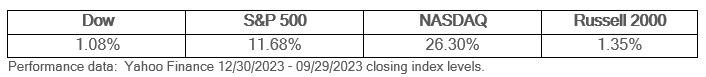

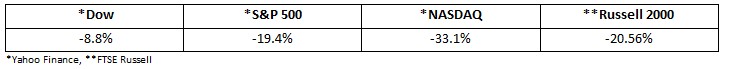

The U.S. government hit the debt limit of $28.4 Trillion (yes, with a T) in July 2 (See Citation 2). In fact, the debt load is a few billion over that as I write this newsletter, and the U.S. Treasury is pushing to get it raised by October 18. Since the U.S. Treasury debt is over the limit, something needs to get done, lest they are forced to default on the payments. Of course, members of congress rarely let that happen. They typical play hard ball with each other and then usually get it done in the 11th hour.

Raising the debt ceiling is not a healthy thing. It’s a necessary evil. With each dollar the government borrows, it steals purchasing power from future generations, and it makes all of us poorer for it. Unfortunately, the alternative is that the government defaults on their obligations. We each know hundreds of people who count on government payments, and no one wants those recipients to be adversely affected by a problem they didn’t create. Beyond the debt, we have other concerns…