2022 Q3 Market Commentary…

There are a lot of shoes dropping now on the U.S. economy that we have been forecasting in previous newsletters. Inflation is running hot. Economic growth, as measured by GDP, is slowing. Interest rates are climbing. Supply chain bottlenecks still exist. Gas prices remain elevated. Housing demand is cooling. Residential rental rates are climbing. Consumer credit is at an all-time high. Consumer confidence is weakening. You get the point. The list is long.

When markets are under extreme duress, the one question we all really want answered is “How much lower will the stock and bond markets go before we bottom out?” While we await the answer (which only ever reveals itself in hindsight), we are forced to grapple with the prospect that markets could get worse before they get better. To further complicate matters, we get brief rallies in markets – called “bear market rallies”- that play with our psyches and create more confusion about market direction.

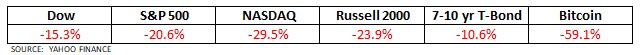

In the second quarter, economic conditions turned on a dime for the worse. There is no sugarcoating it. The stock market showed it. The bond market showed it. In fact, the first half of 2022 was the worst performing first half of a year since 1970. Here are the 2022 first half performance numbers through June 30: