2023 Q4 Market Commentary…

Rising interest rates lower the present value of future earnings for companies, which can cause stock prices to decline. Furthermore, the attraction to own fixed interest rate investments like CD’s and money market funds vs. stock market investments increases as interest rates move higher. Fixed interest rate investments tend to move in tandem up and down with inflation rates while stocks often act inversely.

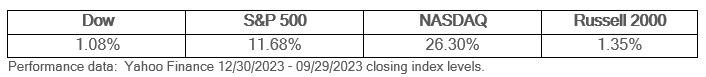

The S&P 500 reversed lower this past quarter due to rising interest rates in addition to several other factors including consumer and commercial credit tightening, reduced personal savings rates, weakening housing data, geopolitical uncertainty, commercial real estate default risk, higher gas prices, to name a few. Still, there doesn’t seem to be a sense of panic in markets, but there are signs of exhaustion. Many of the mega cap growth stocks that buoyed the stock market performance in the first quarter of the year started to wane, as the NASDAQ was the weakest performing sector in Q3, albeit still up significantly for the year. Here are the numbers: Our mood matters in investing, as it does in life. There have been times in my life when a friend asked me to go to a movie or a ballgame, and I responded, “No, I’m not really in the mood.” It’s not that I don’t enjoy a good movie or a fun night at the ballpark. It’s that my mood was too dour to find the enjoyment of those activities at that moment. The same is true in investing. Our perspective towards investing is influenced by our mood, which is usually reflective of current market conditions. Markets haven’t really put me in a good mood since 2021.

Our mood matters in investing, as it does in life. There have been times in my life when a friend asked me to go to a movie or a ballgame, and I responded, “No, I’m not really in the mood.” It’s not that I don’t enjoy a good movie or a fun night at the ballpark. It’s that my mood was too dour to find the enjoyment of those activities at that moment. The same is true in investing. Our perspective towards investing is influenced by our mood, which is usually reflective of current market conditions. Markets haven’t really put me in a good mood since 2021.

When I get moody about markets, I must consciously tell myself to “zoom out”. By that, I mean that I force myself to look at investing in larger chunks of time. Peter Lynch, who authored One Up On Wall Street, stated that “most investors don’t struggle with the market or its companies, but rather with themselves.” This is because investing is hard. It takes tremendous fortitude to not do harm to yourself by panic selling under challenging market conditions. To cope, it’s critical to remind ourselves that adverse market events are temporary. The chart below offers a visual of this truth. It was compiled during the COVID lockdown.https://www.morningstar.com/features/what-prior-market-crashes-can-teach-us-in-2020