2023 Q1 Market Commentary…

The $1.7 Trillion bipartisan spending bill pushed through by Congress at the end of the year was a kick to the gut for investors who were hoping we’d see inflation abate more quickly. A leading research company, Hedgeye, describes it best saying, “We remain in a new, higher inflation volatility regime brought on by deglobalization, confounding energy policies, war, and a wholesale disregard for fiscal prudence at a time of record government indebtedness.”1

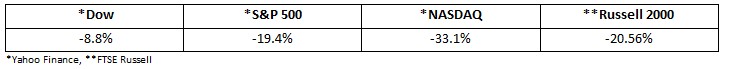

2022 was a slog of gradual, but continual stock and bond values erosion. With the lone exception being the energy sector, every other U.S. stock sector finished 2022 in the red.2 Unfortunately, bonds didn’t provide any shelter either, as yields spiked in the middle of the year, causing bond values to drop significantly. Let’s call it what it was – a “woodshed year”.

A lot of analysts have overlayed a U.S. stock market line graph chart showing 2022 versus 2008, which was a very rough year for markets. The two years hold a strikingly similar correlation. However, the reasons for market declines between the two years were very different. As you may remember, the housing bubble and ill-fated repackaging of mortgages into securities products was a dominant driver of the financial meltdown of 2008. In 2022, the market decline has been a result of a spike in inflation driven by COVID lockdowns, unchecked government spending, and some questionable economic policy decisions. All bear markets typically do share one common thread – low investor confidence – and that is clearly the case right now.

What can we learn from bear markets of the past to help us deal with the current one we are in? First, we must remember they don’t last forever. Second, bear markets have historically been significantly shorter in duration than bull markets. Third, the U.S. stock market has climbed to all-time highs after each bear market it has experienced in history. Of course, past performance doesn’t guarantee future results in markets, and no two recoveries are exactly alike.

We expect continued downward pressure on markets in the first half of 2023, and we’ll continue to favor defensive positions across our managed accounts. However, there are certain market-leading growth positions that we don’t abandon for good reason. We know that market reversals upward have historically often proven to be the most rewarding in their beginning phases. Off the S&P 500 market bottom set on March 6, 2009, the index went on a +48% run through July 31 of 2009. To put it in basketball terms, we don’t want to be so defense-minded that we miss the opportunity to go on a terrific run on offense. That’s coming. We just don’t have a crystal ball to say when.

*1-Hedgeye – “Early Look” commentary – 12/30/22

*2-Fidelity Sectors & Industries table – 01/03/23