2022 Q4 Market Commentary…

From the June 15 lows, the stock market experienced a relief rally lasting one full month before falling back to re-test its lows of the year by the quarter’s end. These are the moves typically experienced when a market is under duress – often referred to as “bear market rallies” and “bear market selloffs”. Out of this volatility, a noticeable behavioral pattern develops among investors. When markets are fiercely advancing upward, investors catch a case of “FOMO” – the fear of missing out – and they want to be “all in”. Conversely, when markets are fiercely declining in value, investors get panicked and want to run for the exits. These traits only become amplified when these market gyrations occur on a day-to-day basis.

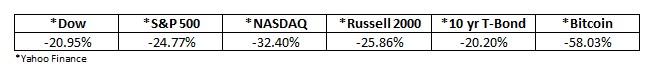

In 2022 so far, both the stock and bond markets have suffered greatly at the hands of inflation, slowing growth, and corporate earnings declines. Here are your year-to-date numbers:

We have called out these challenges in previous newsletters, and the markets are reflecting them now. Currently, we are firmly in a Silo 4 market – rate of change of GDP and inflation both decreasing. It’s more important than ever to put data ahead of feelings, lest we chase our collective tails. The data in Silo 4 conditions call for continued caution.

Do you remember when the Federal Reserve Board had a lone mandate of controlling inflation? Me, neither. Despite what the statutes say, they have always been manipulated by the undue influence of partisanship. One camp wants them to stop raising rates for fear that they will crush economic growth. The other camp wants them to continue raising rates for fear that inflation will worsen. Still, a third faction of people wish the Fed didn’t exist at all! (That could be a great experiment.) At any rate, how would you like to be in their shoes? No, thanks!

Currently, Fed rate decisions show two undesirable outcomes – deep recession or unmanageable inflation. The whole “thread the needle” goal is barely plausible at this point. We are going to take our medicine one way or another. The Fed has publicly stated they will keep raising rates to bring the inflation rate back down to 3%, which led markets lower in September. It is our view that if they continue to raise rates, world economic conditions will continue to deteriorate, and the stock market may come under additional selling pressure.

October is chock full of relevant economic data and has traditionally been a volatile month. Layer the pending midterm elections on top of the data, and we are bound to witness whipsaw trading patterns this quarter. We promise to eat healthy, get our eight hours of sleep and take plenty of Vitamin D to get ready to take this quarter head on.

YEAR-END HOUSEKEEPING ITEMS…

WEBSITE: Please take some time this quarter to log into www.advisorclient.com to verify that all your personal information (address, phone number, email address, IRA beneficiaries, etc.) are up to date. If you have never logged into your account, please contact us so that we can walk you through that process.

RMDs: If you are 72 years old or older and maintain a Traditional IRA account with Future Bright, you have until the end of the year to take your required minimum distribution. If you fall under this category, we will be contacting you to initiate that distribution to meet your requirement if you have not met it already.

PAPER MAIL: Many of you have been receiving paper trade confirmation statements and account statements in 2022. If you are receiving these by paper and not electronically, establishing your online access at www.advisorclient.com should take care of this issue. TD Ameritrade has also indicated that they are required to send paper statements to any clients who have not accessed their accounts online during the last year. If you’d like help setting up online access, please call, email or text us for assistance.

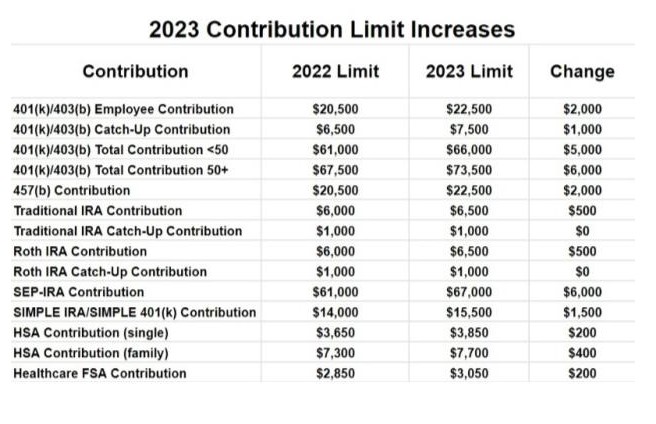

CONTRIBUTION LIMITS ON TAX-QUALIFIED ACCOUNTS: IRS contribution limits across all tax-qualified account types are increasing in 2023. Here are the contribution limits for individuals for each type of account for 2023: