Phew! We soon will be able to put 2020 behind us. The financial markets have been just as abnormal as most other facets of our lives this year. All the relevant U.S. stock indices endured the fastest bear market declines in history…just 16 days! It was swift and severe, yet short-lived, as the markets repaired most of the damage in the form of a V-shape pattern despite most Wall Street “experts” predicting an L-shaped recovery.

The V-shape wasn’t created by the same stocks bouncing back up, but rather by stocks of companies that emerged as beneficiaries of the COVID lockdown. Dinner out to Olive Garden gave way to Dominos pizza deliveries. Trips to the gym gave way to trips to the Peloton bike down the hallway from your bedroom. Business trips by air gave way to Zoom calls from home. It’s been an adjustment, and if our investment strategy hadn’t adjusted with it, the rest of this letter would be a real downer to read.

We hope that you will take satisfaction, perhaps even elation, with your investment returns generated amidst a challenging market year so far. However, the coast is not anywhere near clear. There are more challenges ahead. We still have an election, the potential of a second wave of COVID, insolvency of many small businesses, no guarantee of a second stimulus package, the unknown wait time for a Coronavirus vaccine, and numerous other etcetera’s.

The next six months will be more challenging for asset management than the last six. We typically have the luxury of analyzing data through the lens of normal economic conditions. COVID has created unprecedented economic contingencies – some familiar, some not.

- Are there more job losses to come after stimulus money is exhausted?

- Will federal or local governments force an economic shutdown for a 2nd wave of COVID?

- Will some companies become obsolete while others experience a surge in demand?

- Will investor confidence be affected by election outcomes?

- Will growing income inequality threaten economic growth?

- Will monetary policy keep inflation at bay?

These are the things we think about as we manage your money. Our answers are derived from data we procure from reputable industry sources, not from an emotional response or gut feeling. Letting data drive investment decisions has proven to provide more fruitful outcomes for us.

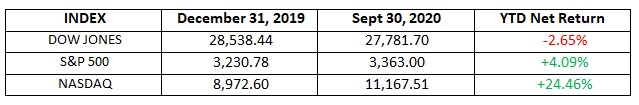

Here are the year-to-date returns for the major U.S. indices…

Thank you for your continued support of Future Bright. Here’s to things looking up going forward!