Our 2020 Q3 Commentary…

A new client recently asked me what I felt was more important – financial planning or investment management. To some extent, they intertwine. Still, it’s a valid question that deserved an honest answer.

At Future Bright, we believe that investment management is paramount for a couple reasons. For one, investment performance is how financial advisors are ultimately measured. Most account turnover is a result of clients’ dissatisfaction with investment returns. That is the nature of the business, and we accept that challenge. Measuring investment performance as it relates to expectations set forth in a financial plan is where the two intertwine. If assumed investment returns projected inside a financial plan exceed the client’s actual returns over time, the financial plan projections are rendered useless.

Secondly, financial plans assume events and milestones that have yet to play out, and they can’t predict how human behavioral traits will change due to abnormal events. Do you feel as financially secure during the COVID-19 pandemic as you did prior to it? Can your financial plan even project how your individual decision-making gets altered under such stress? The viability of a huge stack of paper showing how your financial life is going to play out gets compromised by actual events that don’t always go as planned. Generating good investment returns can mitigate some of that stress.

We believe financial planning is a process of handling life events in manageable doses using timely prescriptive strategies. It doesn’t need to be a written deliverable that comes with an additional fee. Rather, it should be a set of actions that evolve on a constant continuum as life throws things at you that you can’t predict.

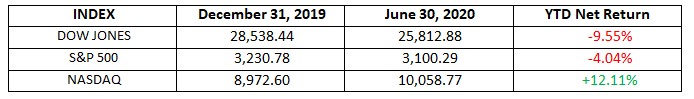

We place investment management at the top of the client needs hierarchy. It is the one facet of financial planning that can accelerate or decelerate the financial goals you have set. In recent years, active management has proven to be essential. Specifically, so far in 2020, while the S&P 500 and Dow Jones 30 levels are still under water by returns year-to-date, many well-known companies like Apple, Microsoft and Amazon are up double-digits. If we ignore any dichotomy in the markets (and they seem to form more frequently than ever before) instead of acting on it, your investment returns can suffer. Subsequently, your financial plan might have to be altered and not in a good way. It’s not good enough to simply be diversified among assets. We must be both diversified and tactical in our approach to what we own and when we own it.

Here are the year-to-date numbers on the major indices. Clearly, there is a dichotomy taking hold…

Thank you for your continued support of Future Bright. Have a great summer season!