“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”

-Ronald Reagan-

“I don't mind going back to daylight saving time. With inflation, the hour will be the only thing I've saved all year.”

-Victor Borge

“Inflation is the crabgrass in your savings.”

-Robert Orben

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”

-John Maynard Keynes

“It is a way to take people's wealth from them without having to openly raise taxes. Inflation is the most universal tax of all.”

-Thomas Sowell

“Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair.”

-Sam Ewing

“Most people who are poor have their money in a bank account that earns negligible interest. With the rapid inflation that we have because of rampant government spending, the people are losing purchasing power - they're actually becoming poorer.”

-Francis X. Suarez

“Slow growth and inflation have a tendency to accompany large deficits and increasing debt as a percentage of GDP.”

-Bill Gross

“In the '30s, the Keynesian stuff worked at least in the sense that you could print money without inflation because there was all this productivity growth happening. That's not going to work today.”

-Peter Thiel

“The power to regulate the value of money does not involve a power to dilute the value of money by inflation, an absurd and self-serving rendering.”

-Thomas Woods

“Thirty years ago, many economists argued that inflation was a kind of minor inconvenience and that the cost of reducing inflation was too high a price to pay. No one would make those arguments today.”

-Martin Feldstein

“Very deliberately, the central bankers have punished savers, pushing interest rates so low that any truly safe investment - and older people are always advised to play it safe - yields a negative return when inflation is factored in.”

-Neil Macdonald

“Inflation is bringing us true democracy. For the first time in history, luxuries and necessities are selling at the same price.”

-Robert Orben

“I continue to believe that the American people have a love-hate relationship with inflation. They hate inflation but love everything that causes it.”

-William E. Simon

“Low and stable inflation in many countries is an important accomplishment that will continue to bring significant benefits.”

-Ben Bernanke

“Each money-printing exercise brings about unintended consequences. These unintended consequences are higher inflation rates than had no money been printed.”

-Marc Faber

About Us

Our Mission

We are committed to operating a financial advisory business that maintains the highest standards of integrity and business ethics as we build relationships with our clients.

Our Vision

We want Future Bright to be regarded as a place where the information, resources and services offered to our clients are reliable, fairly valued, and delivered to clients with their best interests in mind at all times.

What Is Your Personal Inflation Rate?

Inflation doesn’t affect every household the same. For an accurate inflation measurement, each household would benefit from tracking its own “personal CPI”. Simply put, a “Personal CPI” captures how much you spend on your essential goods and services year-over-year within your own household. Equipped with that information, you could calculate a personal annual inflation rate to project how much long-term REAL ROI (investment return net of your inflation rate) you need to generate to meet your long-term money goals.

Not enough analysis is dedicated to this component of financial planning. Your Personal CPI (not the government’s number) should be the lead determinant of your investment risk tolerance. If you have tangible, monetarily quantifiable plans that require your assets to significantly outpace inflation, we need to know what kind of return on investment to aim for and then assess the commensurate risk tolerance required.

HOW TO ACHIEVE REASONABLE INFLATION-ADJUSTED RETURNS?

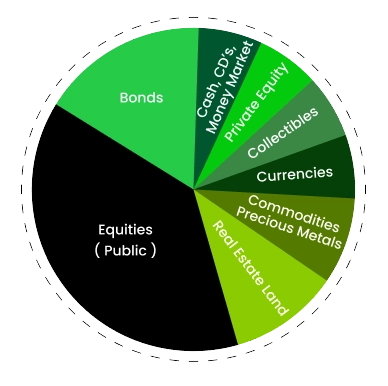

Add non-correlated assets to your portfolio

Asset correlation matters. Positive correlation means that all your assets tend to move in lockstep. Negative correlation is when the movement of one asset goes in the opposite direction of another. Non-correlation is when the price movement of one asset is unaffected by the price of another.

- Gold/Precious Metals

- Commodities

- Currencies

- Real Estate/REITs

- Collectibles

- Private Equity

Multiple studies have shown that a portfolio of non-correlated will tend to be more stable and have less volatility than assets that have only positive or negative correlation. Yet, in our experience, most portfolios that we evaluate are underweighted in non-correlated assets. It’s our belief that investors should cast a wider net.

Know the size of your investing sandbox

- Net worth over $1 million, excluding primary residence (individually or with spouse or partner)

- Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year

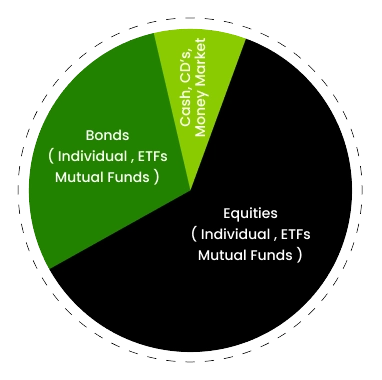

“Non-Accredited”

portfolio composition

“Accredited”

portfolio composition

Keep tabs on your investment fees

Know what you are paying in investment fees. These fees can include, but are not limited to sales charges, commissions, operating expenses, margin interest, asset management fees, 12-B1 fees, and/or insurance and mortality expenses.

You are the client. It’s your money. You have the right to know how much you are paying for investment products and services.

Avoid emotional derailment

If you are like most people, your tolerance for risk changes as market prices change. It’s our human nature to feel more emboldened to invest aggressively when markets are advancing. Conversely, we tend to coil up into a conservative ball and entertain selling things when markets are declining.

”Irrational thoughts are the enemy of conviction.” When we research and select investments for client portfolios, we do so with a confidence that we can maintain the position over the long-term. To achieve successful market returns for your money, your conviction must be greater than your fears. Contrary to common belief, your path to financial independence is not dependent on how much money you have. Rather, it is entirely dependent on the level of conviction you maintain to achieve your stated financial goals. Individuals who are driven more by fear than by conviction may not be suited for investing in markets where principal is at risk.

Blog

Do political outcomes affect monetary and fiscal policy?

- Future Bright

- Stock Market

Increased Volatility Sometimes Happens in Election Years

- Future Bright

- Future Bright, Stock Market

STAGFLATIONARY TIMES AHEAD?

- Future Bright

- Future Bright, Stock Market

Are you onboard with the A.I Supercycle?

- Future Bright

- Future Bright, Stock Market

Let’s get on with it, 2024

- Future Bright

- Future Bright, Stock Market

Feeling Weary?… Then Zoom Out!

- Future Bright

- Future Bright, Stock Market