Fighting Inflation

What Is Your Personal Inflation Rate?

Inflation doesn’t affect every household the same. For an accurate inflation measurement, each household would benefit from tracking its own “personal CPI”. Simply put, a “Personal CPI” captures how much you spend on your essential goods and services year-over-year within your own household. Equipped with that information, you could calculate a personal annual inflation rate to project how much long-term REAL ROI (investment return net of your inflation rate) you need to generate to meet your long-term money goals.

Not enough analysis is dedicated to this component of financial planning. Your Personal CPI (not the government’s number) should be the lead determinant of your investment risk tolerance. If you have tangible, monetarily quantifiable plans that require your assets to significantly outpace inflation, we need to know what kind of return on investment to aim for and then assess the commensurate risk tolerance required.

HOW TO ACHIEVE REASONABLE INFLATION-ADJUSTED RETURNS?

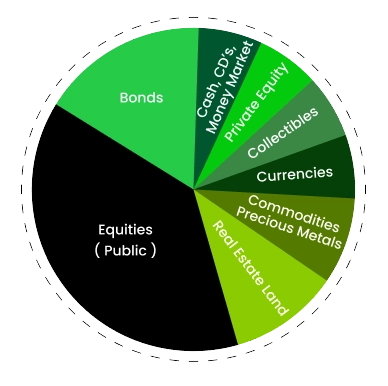

Add non-correlated assets to your portfolio

- Gold/Precious Metals

- Commodities

- Currencies

- Real Estate/REITs

- Collectibles

- Private Equity

Multiple studies have shown that a portfolio of non-correlated will tend to be more stable and have less volatility than assets that have only positive or negative correlation. Yet, in our experience, most portfolios that we evaluate are underweighted in non-correlated assets. It’s our belief that investors should cast a wider net.

Know the size of your investing sandbox

- Net worth over $1 million, excluding primary residence (individually or with spouse or partner)

- Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year

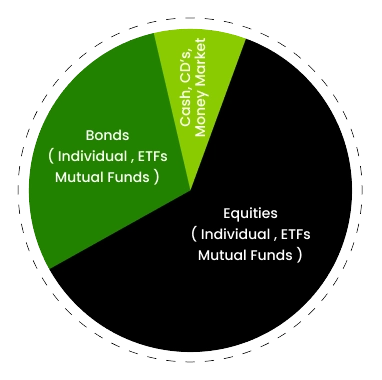

“Non-Accredited”

portfolio composition

“Accredited”

portfolio composition

Keep tabs on your investment fees

Know what you are paying in investment fees. These fees can include, but are not limited to sales charges, commissions, operating expenses, margin interest, asset management fees, 12-B1 fees, and/or insurance and mortality expenses.

You are the client. It’s your money. You have the right to know how much you are paying for investment products and services.

Avoid emotional derailment

If you are like most people, your tolerance for risk changes as market prices change. It’s our human nature to feel more emboldened to invest aggressively when markets are advancing. Conversely, we tend to coil up into a conservative ball and entertain selling things when markets are declining.

”Irrational thoughts are the enemy of conviction.” When we research and select investments for client portfolios, we do so with a confidence that we can maintain the position over the long-term. To achieve successful market returns for your money, your conviction must be greater than your fears. Contrary to common belief, your path to financial independence is not dependent on how much money you have. Rather, it is entirely dependent on the level of conviction you maintain to achieve your stated financial goals. Individuals who are driven more by fear than by conviction may not be suited for investing in markets where principal is at risk.