2022 Q4 Market Commentary…

From the June 15 lows, the stock market experienced a relief rally lasting one full month before falling back to re-test its lows of the year by the quarter’s end. These are the moves typically experienced when a market is under duress – often referred to as “bear market rallies” and “bear market selloffs”. Out of this volatility, a noticeable behavioral pattern develops among investors. When markets are fiercely advancing upward, investors catch a case of “FOMO” – the fear of missing out – and they want to be “all in”. Conversely, when markets are fiercely declining in value, investors get panicked and want to run for the exits. These traits only become amplified when these market gyrations occur on a day-to-day basis.

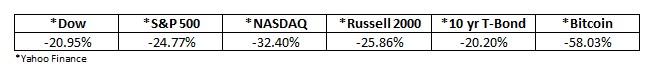

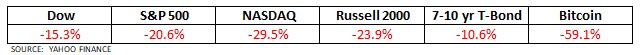

In 2022 so far, both the stock and bond markets have suffered greatly at the hands of inflation, slowing growth, and corporate earnings declines. Here are your year-to-date numbers: